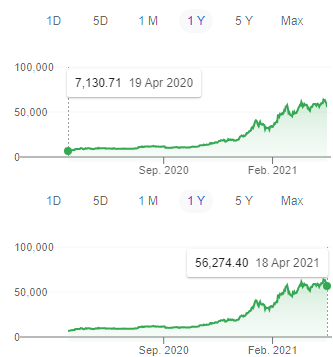

The Price of Bitcoin Went From $7100-$56000USD+ in one year – April 19, 2021

If you’ve cashed out your Bitcoin returns, you’ve done very well for yourself if you’re holding on for even better returns, a the moment it appears the wind is in your sails, one would assume there will be minor hiccups along the way but when you look at the charts, Bitcoins accession almost appears to look normal, but one can’t help but ask the question, is Bitcoin reaching its peak?

Bitcoin from my perspective appears to be headed in a direction in which it’s a digital cryptocurrency for the affluent. The coss associated with Bitcoin the larger in gets pins the most of its users at the bottom of the pyramid, maintaining the Bitcoin infrastructure with their transactions, which are in the grand scheme of things being taxed by the facilitators of each transaction.

With that said, taxes are higher in the fiat world and if the global governments follow the Chinese Communist Party down this road of CENTRALIZED digital dollars, all of a sudden decentralized cryptocurrencies appear to be the far superior option. Because most Western Nations are heading towards this idea of Universal Basic Income, which in actuality is the Federal Government paying people to live, the market reaction to such a scheme will equate shifts to how the private sector operates.

Cuba has a Univeral Basic Income system and the end result is that they have an almost non-existent private sector. Consumer behavior changes, when non-market participants are able to spend money they didn’t earn. Humans that don’t imagine money to be simply a convenient form of Barter, have a hard time comprehending that there is such a thing as good money and bad money.

Hyperinflation tends to occur when the private sector rejects government money, because government money with too many regulations, dissolves into a liability for private sector participants. If we really are heading down this digital dollar road, Bitcoin and decentralized currencies, in general, will become ‘digital gold’.

Now, why I don’t think any central government wants to go down this digital dollar road is that they’d have to go war with bitcoin the way they went to war with Gold! My belief is that all roads are leading to a deflationary crash, which doesn’t make sense to most people with all the money printing going on.

Austerity Measures and Bitcoin

But what I think most people tend to forget with all the money printing are all the debt instruments attached to it, these debt instruments are consuming the money being printed. Furthermore inflating away the debt comes at a cost. When you inflate away the debt, the cost of living goes up because the cost of doing business goes up.

In Venezuela, as an example, the COST OF LABOR cares nothing about the hyper-inflating Venezualan bolivar if I’m a mechanic and the cost of a part costs this price in Bolivars and most cost to travel costs this amount and my profit margin to take care of my family costs this amount, then that’s the price for me to do the job end of story. Currently, Venezuelans measure their currency to the U.S dollar.

With that said, the cost of living in U.S dollars for U.S citizens goes up because of government spending and government regulations within the United States, once the numbers start making more U.S citizens bankrupt and unable to start a new life because the cost of living is too high, all roads lead to austerity measures, of course, there will be people who fight back against austerity measures, but as is the case in Venezuela, the cost to produce something is the cost to produce something and the cost of labor is the cost of labor, money is convenience, but people with the skills to pay the bills aren’t going to subjugate themselves to exploitation or slavery just because a government made a Universal Basic Income promise it can’t pay for.

In this type of deflationary environment, I’m not sure how Bitcoin holds up, because not even gold holds up well in a deflationary environment. Prices going up in government money don’t always equate to positives for commodities or even digital dollars.

The destruction of the Welfare State comes from the proletariat, as an example I was looking at the salary of an HVAC technician, $56,000 a year. Now people fighting for a UBI want $24,000. Now, what’s ignored about the HVAC Technician are their costs, taxes and simple costs to go to work will make an HVAC Technician make the same amount of money as a person on UBI.

These are the deflationary problems I see in the future if things continue the way they are and this is why I don’t see a digital dollar lasting very long. Because if any central banking entity can simply expand the money supply by clicking a button with no checks or balances, chances are good money is going to exit the system, which would equate to the governments of the world going to war with cryptos the way they’ve gone to war with the private ownership of gold!

Interesting times ahead!