Republican U.S. Senator Alaska’s Dan Sullivan states the following regarding Ukraine: “We still have NATO allies, Canada one, who just freeload. And it’s getting a little tiring.” – May 11, 2022,

A few days ago it a writer brought to everyone’s attention the fact that Canada’s PUBLIC finances were some of the lowest in the G7. Well, NATO countries have all the G7 countries excluding Japan. Why I bring this up is that one could argue why Canada has the lowest debt-to-GDP ratio in NATO? Canada’s federal government has been open about not committing to the NATO agreement, and instead of withdrawing, Canada wants all the perks but doesn’t want to pony up the money?

In the context of total public debt, Canada has the lowest net debt-to-GDP ratio in the G7, the analysis notes. “And while higher than prior to the pandemic, Canada’s total government debt position continues to compare very well to other major advanced economies.”

Donald Trump was the first U.S President I know of to bring light to the reality that NATO allies weren’t paying their fair share. Canada led by Justin Trudeau was one of the countries that scoffed at the idea of paying their fair share to NATO. One of the reasons many of us argue Putin decided to go to war with Ukraine is the inflated price of oil, which is derived from the majority of NATO allies deciding to wage war on DOMESTIC fossil fuel production.

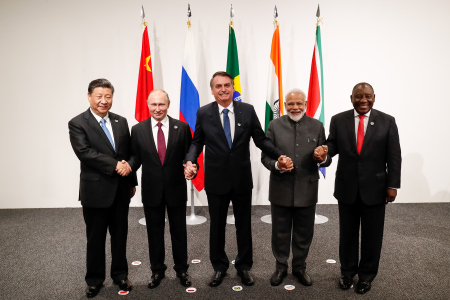

People like me argue that the inflated cost of oil helps BRICS nations(Brazil, Russia, India, China, and South Africa) being that oil is priced in U.S dollars, as long as Russia can get access to U.S dollars, it can profit greatly from its energy production. Most countries including Canada, don’t want their currency to be priced too high next to the U.S dollar in fear their cost of production rises.

One thing communists or countries that used to be communist nations understand is the importance of controlling the means of production. When you control the means of production, the fewer competitors you have in the marketplace, the better. Well, because of the U.S and Canada’s war on fossil fuel, the price of oil can’t be driven down, this higher priced oil in U.S dollars when exchanged into Russian Roubles, increases Putin’s DOMESTIC purchasing power, and by that I mean his ability to finance his military spending

Now, people who comprehend how this Putin-Ukraine war is being financed by Putin, are annoyed with Progressive leadership all of which have an extremely low FINANCIAL and Economic IQ. But then again, we’re not sure if these Leftists have a low financial IQ because they appear more obsessed with scoring political points. This is one of the reasons why as an example U.S. Senator Dan Sullivan is trying to stir up some emotions amongst Americans about who is bearing the most costs in NATO and getting very little BENEFIT for it.

Click Here For The Live Marketing HQ Official Copywriting Guide

America, the policemen of the world are not only committing troops to NATO, but they’re also spending the money. Canada who’s military probably couldn’t survive an attack from the Philippines without the United States’ assistance in openly scoffing at the idea of paying its fair share to NATO. Canada has been disrespectful in this regard for a very long time, although one could blame Justin Trudeau exclusively, the reality is Canada has been paying its fair share to NATO for decades, Canadian PMs even brag about not paying their fair share, they imagine this savings makes them smart.

U.S. Senator Dan Sullivan also appears to be angling for the U.S to get out of NATO entirely? If you think that’s a stretch, you don’t know some of these U.S Senators. It’s important to understand that in the event America loses its place in the world, Canada’s economy would be in shambles, and Canada’s private sector continues to be increasingly reliant on debt, why Canada’s public sector should be concerned about this is if bankruptcies start happening in droves in Canada, the Canadian PUBLIC sector will be in shambles.

As we’ve observed, during times of trouble everyone wants to be in the U.S dollar, if the Canadian dollar fell off a cliff, only Canadians would care. Furthermore, if the Canadian dollar lost its standing in the world, you might see a lot of Canadian skilled labor fleeing to the United States. If you ask me, there are a lot of warning signs in the Canadian economy, that signal to me, that we could be headed for a wave of bankruptcies.

I give credit where it’s due, the Canadian consumer has faired well, so far, but as consumer price inflation rages forward, people in debt are even if interest rates remain near zero will find their cost of living accelerating, which doesn’t only flash recession indicators but could very well lead to more debasement of the Canadian dollar.

You have to understand something about debasement in this fiat monetary system. As an example minimum wages won’t allow certain costs to come down, meaning that certain costs will be pushed up, these increased costs, will make Canadian labor expensive if the forex markets refuse to allow the Canadian dollar to go below a certain threshold in relation to the U.S dollar.

Now, I’ve been calling for it cost Americans $0.60 to purchase $1 Canadian dollar for years now, this never happened, I was wrong on this, at least my timing was wrong, but I still see things this way, that thought can’t escape my mind. The labour force participation rate in both Canada and the United States is down, however, the U.S dollar is in more demand than the Canadian dollar, meaning, that the U.S has an advantage in attracting skilled labor in comparison to Canada.

Publish Your First eBook Today Click Here For eBook Designing and Ebook Publishing all in one

It’s not to say that Canada can’t attract skilled labor, but I’ve seen it myself, skilled labor being trained in Canada only to emigrate to the United States. If you’re a skilled laborer, the U.S has a lower cost of living and a stronger currency. Compounding the problem is that low-skilled labor jobs in Canada are finding their purchasing power shrinking as the various levels of the Canadian government seek to keep asset prices from crashing.

This is the problem when you don’t pay your bills, you’ll also neglect your glass house. The Canadian media has done its best to keep trust in this government strong and positive and Justin Trudeau has done his best to dodge questions about the economy. These political strategies work until they don’t, I won’t be one to say the economy will crash tomorrow, but when you start looking at the Canadian economy for what it is, you can become a better investor.

U.S. Senator: Canada’s a freeloader on defence and it’s getting tiring | cbc.ca

Interesting times ahead!